BECOME A

savvy investor

EVEN IF YOU'RE A BEGINNER

AND IN DEBT

Enrollment is currently closed!

Sign up for my FREE investing class

Tuesday, April 9, 5:30pm PST

Let Me Tell You Why This Course Was Made For

Someone Just Like You

This Course is For You if:

- You know you should be investing, but you're scared and have no idea where to start.

- You have some investments but you're confused about them and whether you're "doing the right thing."

- You don't want to wait until you're 65 years old to retire and enjoy your life.

- You know a little about investing, but you're not optimizing your money for financial independence.

- You have money sitting in a savings account and you don't know what to do with it.

- You're overwhelmed at the thought of learning about the stock market.

- You have some debt, but you're ready to crush it and start investing while you do it.

- You've tried learning about investing, but all the material was really dry and boring.

You're sick of feeling or thinking this way!!!

InsteadYou Want TO:

- Supercharge your money for a long-term goal like buying a home or a dream vacation.

- Build a bank account that never stops growing.

- Create passive income and start living the life you deserve.

- Pass on generational wealth and money lessons to your children and family members.

You Don't Want to Miss Out On all of this!

- 20+ Videos to Teach You Everything You Need to Know to Start Investing and Plan Your Financial Independence Journey. ($2,000 VALUE)

- An exclusive all access pass to my multi six-figure investment portfolio where I share which index funds, ETFs, and stocks I buy and why. ($1,000 VALUE)

- My custom-made Financial Independence Wealth Planner. ($795 VALUE)

- Checklists and Worksheets to guide you through each class and keep you accountable. ($500 VALUE)

- LIFETIME Access to the videos inside Slay The Stock Market™. ($PRICELESS)

- 30+ hours of coaching class recordings that are keyword searchable ($500 VALUE)

Plus THREE Bonuses!

Bonus #1

Exclusive Group Coaching Classes With Me for Two Months! I Go Live Once a Month to Answer All Your Money and Investing Questions.

($2,000 VALUE)

Bonus #2

Extra Classes to Teach You How To Make Money with a Side Hustle so You Can Pay Off Debt Faster & Invest More Money. Guest Appearances From Expert Side Hustlers!

($1,500 VALUE)

Bonus #3

Two Extra Classes To Teach You the Method I Used to Pay off $150,000 of Student Loans While Building a $300,000 Portfolio.

($1,500 VALUE)

TOTAL VALUE: $9,795

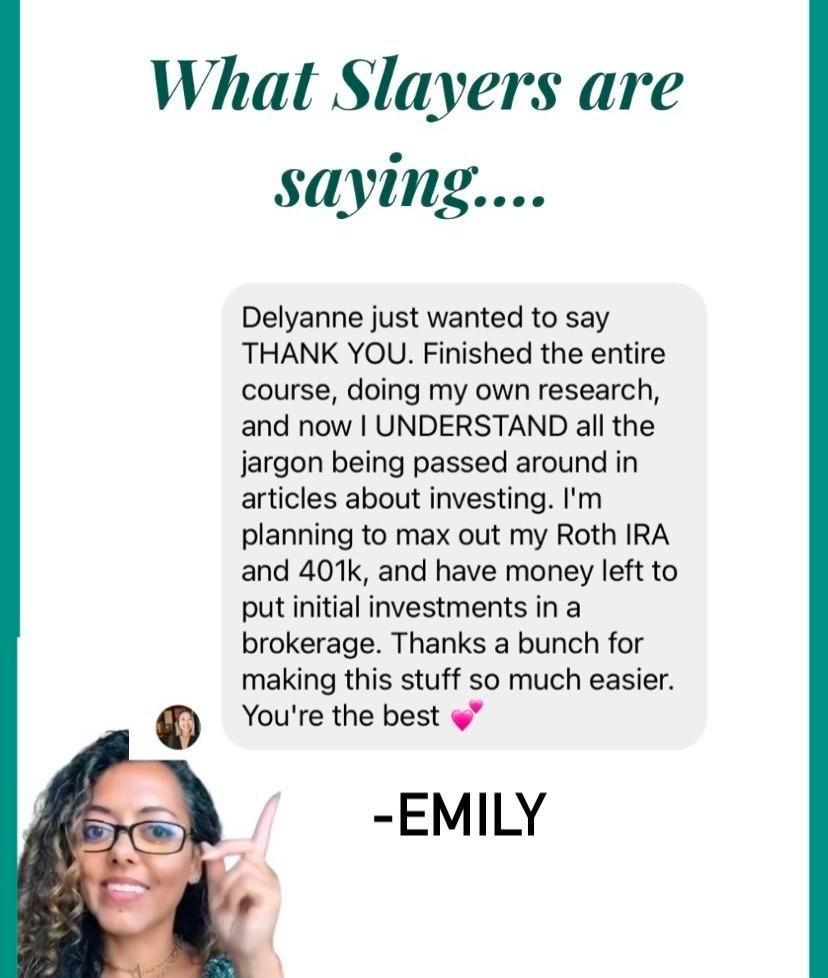

“YAAAAASS

Kate Hardin

“Thanks to your class my Roth has been making me money. I had $4k sitting in a credit union Roth IRA account for years without it making me a dime. Honestly… it was like pennies since it was just sitting in a holding pot. I moved it to Vanguard and added more to it and look at those returns. Thank you!!! The class literally paid for itself.”

“👏👏👏yesss! You’ve helped so many— 2 days ago I paid off my last credit card debt— I am investing into my 401k— IRA— and have 6 months emergency funds saved— No debt— and a single mom. I also quit my full time job and now pursuing my passion in esthetics part time— and all thanks to you for sharing your knowledge and helping us first gens the ropes to financially independent. I am so HAPPY FOR YOU!”

Glamrose beauty

“Woohoo! Keep going girl!!! What a great community you have built! Learning so much. I’m so happy I found you. And for anyone wanting to learn more about your finances and investing take Delyanne’s Slay the Stock Market® course! It’s a game changer!!! Congrats!”

Charlene H.

Real Slayers, Real Results

as seen in

meet

caroline

Caroline (34 years old) thought she was on track with her retirement, but felt there was something she was overlooking.

When she started Slay the Stock Market®, she realized that she didn’t actually understand any of the investments inside her 401k or how much she would retire with.

She learned that by making a few changes to her portfolio and by calculating her financial independence number

she could retire early by 46 years old and move abroad!

@houndstoof

meet

LAUREN

Lauren had money saved up, but didn’t know what to do with it. She had been hoarding cash in a bank account.

Even though she was working a full-time job and running a business, she found Slay the Stock Market® easy to follow since she could watch it on her schedule. She used the Wealth Planner to calculate her financial freedom number and realized that it was possible for her!

She opened a Roth IRA, increased her 401k contributions.

She started saving more money for her emergency fund.

@gathernchill

meet

Nanci

After graduating college in 2019, Nanci (24 years old) realized she wanted more control over her money especially as someone who’s first-gen.

Because her parents have already retired, she knew she had to be proactive for her financial future.

After taking Slay the Stock Market®,

she opened and funded her ROTH IRA and started saving more money!

@naysayingnanci

meet

Julia

Julia had opened a retirement account after graduating college and started contributing to it, but after starting a business, investing had fallen to the side.

She signed up for Slay the Stock Market® to re-focus on her goals and get the accountability she needed to actually take action.

She now knows her numbers inside and out.

She has started saving and investing more!

@jualiaavery

DON'T JUST START YOUR INVESTING JOURNEY

SLAY IT!

SAVE MONEY

Empower yourself to become savvy long-term investor instead of hiring expensive financial planner to manage your investments. Save yourself from making the typical newbie mistakes that will cost you money.

SAVE TIME

Learn the foundation of investing quickly instead of spending months researching and reading boring material.

SIMPLICITY

Investing doesn't have to be complicated! I curated & simplified all the information you actually need to invest with confidence.

STEP-BY-STEP GUIDANCE

Videos and checklists to make sure you're on the right track every step of the way. No more guessing!

MENTORSHIP

Get LIVE group coaching sessions with me to ask anything about the material. No more going at it alone and feeling overwhelmed!

Real Slayers, Real Results

Hey! I’m Delyanne.

I'm an EX-employment attorney and money coach.

Empowering people to invest & grow wealth is my passion. I believe with the right tools and mindset, anyone can build life-changing wealth.

I teach new investors how to invest their way to financial independence because we all deserve to retire WHEN and HOW we want to.

I didn’t start investing until I was 28. I’m now 40 and on track to reach Financial Independence by 45. My plan is to move to Portugal, travel the world, and enjoy my wealth with peace of mind.

Join me on this revolutionary journey!

This course is

what I wish I had when I started investing!

I spent so much time and money learning to invest.

I bought books, listened to podcasts, read blogs, and followed countless personal finance pages on social media.

My head was spinning and I was feeling MORE and MORE overwhelmed!

When I finally wrapped my head around investing, I didn’t know how to put it into action.

Many of the books or blogs I read were out-of-date and didn’t show me how to actually open an account and start investing.

The more I learned, the more I became paralyzed, and the less time I spent taking action.

What’s the most valuable resource you have that will make you more money than money itself??

TIME.

The more TIME your money spends in the stock market, the faster your money WILL GROW.

The more TIME you waste trying to figure out investing, the LESS MONEY you’ll make!

That’s why I created Slay The Stock Market®!

Take a Peek Inside Slay The Stock Market®

CLASS ONE

Wealth Planning & Debt Payoff Strategies

A step-by-step walkthrough on how to use my custom-made wealth planner to track and plan your finances. You'll have a clear and easy to follow budget and net worth tracker, debt payoff and savings tracker, and an investment plan worksheet.

Bonus #1 is also included here: How to Slay Your Debt and the method I used to pay off $150,000 in student loans while building a $300,000 portfolio.

CLASS TWO

How the Stock Market Works

You'll learn about the history of the stock market so you can understand how it's performed and what that means for the future. You'll understand what you can buy including Index Funds, ETFs, stocks, and bonds.

Understand why timing the market is a losing battle and what you should focus on instead.

CLASS THREE

Understanding Investment Accounts

What's the difference between a Roth IRA and a Traditional IRA? You'll know after this class. You'll finally understand all the different types of accounts that you can use to invest and how they work together to save you the most in taxes. Find out how much you're paying in fees inside your 401k, 403b, or 457b plans.

Learn how to access your retirement accounts early without paying penalties in order to fund your early retirement. This class also includes step-by-step videos on how to open an investment account.

CLASS FOUR

Shopping For a Broker

Learn the differences between all the brokers out there and which one is right for you. Learn which brokers and apps you should avoid and why. You'll be able to decide whether you want to self-manage, use a roboadvisor, or hire an advisor to manage your investments.

CLASS FIVE

The Three Laws of Investing

It's time to learn how your Financial Independence Retire Early number. How much do you need to be independently wealthy and never work again?

You'll also learn the three laws of investing that will help you lower your risk and save you money.

CLASS SIX

Organizing Your Portfolio

Have you ever looked at an index fund chart and had no idea what it meant? You will after this class. I'll show you how to shop for Target Date Index Funds, Index Funds, and ETFs. You'll apply everything you learned to create a portfolio that matches your goals. No more wondering and guessing what you should buy, how much, and when. This is when you design your investment strategy.

BONUS CLASS ADDED: I reveal all the investments inside my portfolios and why I invest the way I do. See exactly which index funds, ETFs and stocks I buy and how much.

CLASS SEVEN

Investing Strategies & Mindset

Channeling the right mindset so that you're a successful investor whether the market is up or down. How to avoid common investor mistakes and implement strategies to increase your chances of success!

CLASS EIGHT

How To Side Hustle Your Way to Financial Independence

It's time to make some money! Financial independence isn't just about cutting back on expenses. I want you to live your best life today and tomorrow so I'm bringing in side-hustle experts to teach you different ways to make money so that you can pay off your debts and speed up your investment goals.

Frequently Asked questions

You’re a good fit if you’re a USA resident and looking to understand how to invest or to invest towards financial independence. You’re looking for either an introduction to investing or a better understanding of how investing works and how to maximize its advantages. Maybe you’ve been investing in a 401k/403b, using a financial advisor, or a roboadvisor and you’d like to have a better understanding about your investments and whether you’re actually on track.

This is NOT for you if you’re looking for a get-rich-quick-scheme, hot stock tips, or if you want to learn about day trading, options trading, or crypto.

I recommend that everyone have a 3-month emergency fund saved before they start investing.

I don’t believe that you need to be 100% debt free to start investing. In fact, I invested while paying off $150,000 of student loans. I did this while building a $300,000 investment portfolio. Thanks to that decision, I am on track to retire by 45.

This course is still useful if you have high-interest debt and want to learn about investing so that when you’re finally ready, you can start right away instead of losing more valuable time.

So much has changed with investing that it’s now accessible to everyone! It’s free to open an investment account and you can start investing with as little as $5 with some brokers.

As a BONUS, you have access to the Slay the Stock Market community for 2 months.

You’ll be able to post questions to the community page and I’ll answer them during the LIVE Q&As. Even if you can’t make it live, I’ll still answer your question on camera or in the community feed.

The Live Q&As are on Wednesdays at 5:30pm (PST)/8:30pm (EST). They are all recorded and the replay is posted inside Slay the Stock Market.

At the end of the 2-month period, you may purchase a 30-day extension for $127. This is optional.

There are 8 classes with approximately 20 hours of video instruction that make up the core of the course. There is also a wealth planner and assignments after each class which may take you a few more hours.

There are also over 30 hours of past Q&As that you can search through and watch at your leisure.

The timeframe and pace at which you complete the core of the course is totally up to you!

You have lifetime access to the videos inside the Slay the Stock Market® course.

About 80% of this course would still be applicable and useful to you. However, certain concepts do vary by country and no one course can cover all these differences. For example, investment accounts are differently named and have different criteria in each country. What we refer to as a ROTH IRA in the USA is referred to as an ISA in the UK and as a TFSA in Canada. Tax laws are also different in each country. So you will have to account for these differences as you work through the course.

If you’re Canadian, I have great news! I have added bonus classes to bridge some of the gap between USA and Canadian investing.

Absolutely not!! I’ve had students in their late 50’s and 60’s take my course and they got tremendous value from it.

The older you are, the more critical it is that you understand investing because you really have no time to waste. Every day that passes is precious time that you can be optimizing your financial plan.

You have lifetime access to the videos inside Slay the Stock Market® including all the LIVE Q&A replays. You can watch it at your own pace.

I suggest you try to complete it within 60 days so that you can take advantage of the 2-month access to me during the group coaching sessions. That way you can ask questions as you make your way through the course.

However, if time runs out, you’ll have the option to purchase a 30-day pass and rejoin the community at any time! Access to this community is only available to those who purchase the course.

Here's my 100%

Money-Back Guaranteed Promise To You:

Take 7 days to review the Slay The Stock Market® Course. If you don’t feel more confident about investing, I will issue a full refund if you watch all the videos for classes 1-8 and submit a copy of your completed wealth planner.

Just contact me directly for an immediate refund.

No refunds are available after 7 days from the purchase date.

what the experts are saying

what the community is saying

Disclaimer:

The information provided in the Slay the Stock Market® Course and Slay the Stock Market® Community is not intended as investment, tax, or legal advice. All information provided is for educational purposes only. I am not a Certified Financial Planner or a Certified Public Accountant. Investing in the stock market has risks and may result in loss of principal and capital gains. Past market performance does not guarantee future results.

Any product mentions made or recommendations provided by Delyanne The Money© Coach and Delyanne Barros are made solely in the author’s opinion and do not constitute professional financial or legal advice. All content is for educational purposes only.

© 2021 Delyanne The Money Coach LLC. All Rights Reserved. Privacy Policy | Terms of Service | Disclaimer